Mileagewise - Reconstructing Mileage Logs for Beginners

Table of ContentsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedLittle Known Questions About Mileagewise - Reconstructing Mileage Logs.Mileagewise - Reconstructing Mileage Logs Can Be Fun For EveryoneSee This Report on Mileagewise - Reconstructing Mileage LogsLittle Known Facts About Mileagewise - Reconstructing Mileage Logs.Mileagewise - Reconstructing Mileage Logs for Dummies6 Easy Facts About Mileagewise - Reconstructing Mileage Logs ShownHow Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

This consists of costs such as fuel, maintenance, insurance policy, and the lorry's depreciation. For these costs to be thought about insurance deductible, the lorry needs to be used for company objectives.Detours for personal tasks throughout these trips would not contribute to deductible mileage. Only gas mileage straight associated to organization can be subtracted. Insurance deductible driving gas mileage describes the miles you cover throughout service operations that you can subtract from your taxes. Not all miles count, and the Irs (INTERNAL REVENUE SERVICE) has peculiar guidelines.

In between, diligently track all your business trips noting down the starting and finishing readings. For each journey, document the area and service purpose.

Examine This Report on Mileagewise - Reconstructing Mileage Logs

This includes the overall service gas mileage and total mileage build-up for the year (service + individual), journey's date, destination, and function. It's essential to tape-record tasks promptly and maintain a coexisting driving log describing day, miles driven, and service purpose. Below's just how you can enhance record-keeping for audit purposes: Start with making certain a precise mileage log for all business-related traveling.

Top Guidelines Of Mileagewise - Reconstructing Mileage Logs

Those with significant vehicle-related expenses or distinct problems may benefit from the real costs approach (free mileage tracker app). Please note electing S-corp standing can change this computation. Ultimately, your selected approach should straighten with your particular economic goals and tax obligation situation. The Criterion Mileage Rate is a procedure released each year by the IRS to identify the deductible prices of running a vehicle for service.

There are 3 means: To make use of the journey setup on an odometer, merely push the odometer's "journey" switch up until it presents "Journey A" or "Journey B". Constantly keep in mind to reset before each new trip for accurate mileage recording.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Whenever you use your auto for organization journeys, tape-record the miles took a trip. At the end of the year, once again take down the odometer reading. Compute your overall business miles by utilizing your begin and end odometer readings, and your recorded service miles. Properly tracking your precise gas mileage for company journeys help in corroborating your tax reduction, particularly if you select the Criterion Mileage method.

Maintaining track of your gas mileage manually can need persistance, but bear in mind, it can save you money on your tax obligations. Tape-record the total gas mileage driven.

What Does Mileagewise - Reconstructing Mileage Logs Mean?

(https://www.anyflip.com/homepage/zgufb#About)Timeero's Fastest Distance attribute suggests the shortest driving path to your workers' destination. This attribute boosts productivity and contributes to set you back financial savings, making it an important possession for organizations with a mobile workforce.

Such an approach to reporting and conformity simplifies the frequently complicated job of managing mileage expenditures. There are numerous benefits connected with making use of Timeero to keep track of mileage.

What Does Mileagewise - Reconstructing Mileage Logs Do?

With these devices in usage, there will certainly be no under-the-radar detours to increase your repayment prices. Timestamps can be discovered on each gas mileage entry, boosting trustworthiness. These extra verification steps will keep the IRS from having a factor to object your mileage documents. With exact gas mileage tracking modern technology, your staff members don't have to make rough gas mileage quotes and even bother with gas mileage expenditure monitoring.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

A lot of gas mileage trackers allow you log your trips manually while calculating the range and compensation amounts for you. Many also included real-time journey tracking - you require to begin the app at the beginning of your journey and quit look at this now it when you reach your final location. These applications log your begin and end addresses, and time stamps, along with the total range and repayment quantity.

What is the finest gas mileage tracker application? The very best gas mileage tracker app for you will certainly rely on your needs and the neighborhood demands of what you must be logging for your gas mileage compensation or reductions. We suggest trying to find an application that will track your mileage instantly, log all the needed information for trips such as the time, destination and objective, and provide you with gas mileage reports you can utilize for your reimbursement.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Buy

Andrea Barber Then & Now!

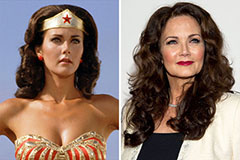

Andrea Barber Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Meadow Walker Then & Now!

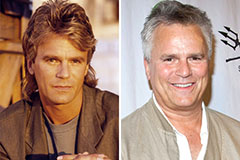

Meadow Walker Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!